Your Complete Guide to Smart Silver Investing in 2025

If you’re looking for silver rounds for sale, you’ve probably noticed how many options exist today. The good news is that you can easily buy silver rounds online from trusted dealers without leaving your home. Silver rounds offer a simple way to own physical silver at prices close to the metal’s actual value. This guide will walk you through everything you need to know about purchasing these popular silver pieces.

Understanding Silver Rounds: The Basics

Silver rounds look similar to coins, but they’re different in important ways. A silver round is a privately minted piece of silver, usually weighing one troy ounce. Unlike government-issued coins, rounds don’t have a face value or legal tender status. This distinction actually works in your favor because you’re not paying extra for collectability or numismatic premiums. Most silver rounds contain .999 fine silver, which means they’re 99.9% pure silver. Some producers make rounds with .9999 fineness, adding even more purity. The front and back typically feature various designs, from historical figures to wildlife scenes to abstract patterns. Private mints create these designs, and some become quite popular among collectors. The main appeal of silver rounds comes down to cost efficiency. When you buy a round, you’re paying for the silver content plus a small premium over the spot price. This premium covers minting costs and dealer margins. Compared to silver coins from government mints, rounds usually cost less per ounce. That makes them attractive for people building silver positions on a budget.

Why Buy Silver Rounds Online

Shopping for silver online has changed the precious metals market completely. Ten years ago, most people visited local coin shops to make purchases. Today, online dealers offer better selection, competitive pricing, and convenient delivery right to your door. Online shopping lets you compare prices across multiple dealers in minutes. You can check spot prices in real time and see exactly how much premium each dealer charges. This transparency helps you make informed decisions and find the best deals available. Most reputable online dealers update their prices throughout the trading day as silver prices fluctuate. Another advantage is selection. A typical local shop might stock 10 to 20 different round designs. Online dealers often carry hundreds of options from various private mints. You can choose rounds based on design preference, mint reputation, or current promotions. Some dealers even offer exclusive designs you won’t find anywhere else. Security is another consideration. Established online dealers invest heavily in secure payment systems and insured shipping. When you buy from a trusted source, your purchase is protected from order placement through delivery. Most dealers use discreet packaging that doesn’t advertise the contents.

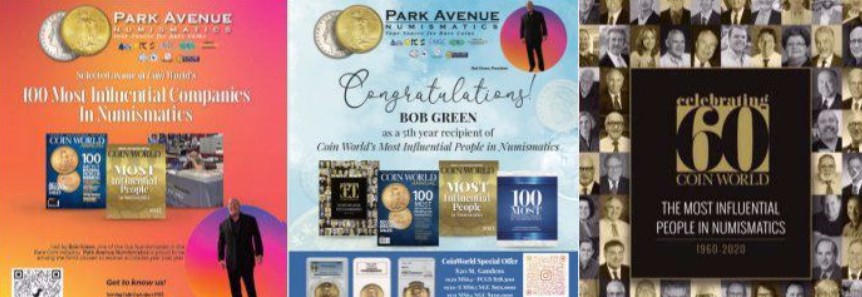

Park Avenue Numismatics: A Trusted Name in Silver

Park Avenue Numismatics has served precious metals investors for years with a focus on quality products and customer service. Based on their reputation in the industry, they offer a wide selection of silver rounds alongside coins, bars, and collectibles. Their website provides educational resources to help new buyers understand the market and make confident purchasing decisions.

How to Choose the Right Silver Rounds

Not all silver rounds are created equal, and knowing what to look for helps you get the best value. Start by checking the purity. Standard rounds contain .999 fine silver, which is the industry norm. Some premium rounds offer .9999 purity, though the price difference is usually minimal.

Next, consider the mint that produced the rounds. Well-known private mints like Sunshine Minting, Buffalo, and others maintain strict quality standards. Their rounds are easily recognizable and widely accepted when you decide to sell. Lesser-known mints might offer lower premiums, but their rounds may be harder to resell later.

Design matters if you care about aesthetics, but it shouldn’t be your primary concern for investment purposes. Some people prefer generic designs that focus on silver content. Others enjoy rounds with detailed artwork or historical themes. Either choice works fine as long as the purity and weight meet standards.

Weight verification is crucial. One troy ounce equals about 31.1 grams. Reputable dealers sell rounds that meet this weight specification. When your order arrives, you can verify weight using a digital scale if you want extra assurance.

Understanding Pricing and Premiums

Silver round prices consist of two main components: the spot price of silver and the dealer premium. The spot price changes constantly based on global supply and demand, economic conditions, and market sentiment. You can check current spot prices on financial websites or dealer sites that update throughout trading hours.

The premium is the amount dealers charge above spot price. This covers manufacturing costs, distribution, and profit margins. Premium percentages typically range from 5% to 15% over spot for standard rounds. Factors that affect premiums include order size, current market conditions, and specific round popularity.

Buying in larger quantities usually reduces your per-ounce premium. Many dealers offer price breaks at 20, 100, or 500-ounce increments. If you’re serious about building a silver position, buying tubes of 20 rounds often provides better value than purchasing individually.

Market conditions also impact premiums. During high-demand periods, premiums tend to rise as dealers struggle to maintain inventory. When demand softens, premiums often compress. Smart buyers track these patterns and purchase when premiums are reasonable.

Pros of Buying Silver Rounds Online

Several advantages make online purchasing attractive for silver investors. First, you get access to competitive pricing across multiple dealers. This competition benefits buyers by keeping premiums in check and ensuring fair market prices.

Second, convenience can’t be overstated. You can browse inventory, compare options, and complete purchases anytime that suits your schedule. No need to arrange trips to physical stores during business hours or deal with limited local inventory.

Third, online dealers often run promotions and special offers that local shops can’t match. These might include free shipping, reduced premiums on bulk orders, or special pricing on new product releases. Signing up for dealer newsletters helps you catch these opportunities.

Fourth, product variety exceeds what most physical locations can stock. You’ll find rounds from numerous mints in various designs and sizes. This selection lets you choose exactly what fits your investment strategy and personal preferences.

Cons to Consider Before Buying

Online silver shopping isn’t without potential drawbacks. The biggest concern for many buyers is not being able to inspect products before purchase. You’re trusting the dealer to ship what they advertise. This makes choosing reputable dealers absolutely essential.

Shipping delays can occur, especially during busy market periods. While most orders arrive within a week, you might wait longer during high-volume times. This delay means your investment isn’t in your hands immediately after purchase.

Security during shipping presents another consideration. Although dealers use discreet packaging and insurance, packages can still be lost or stolen. Most dealers resolve these issues quickly, but it adds a layer of stress compared to walking out of a shop with silver in hand.

Payment options might be more limited online. Some dealers charge extra for credit card purchases to offset processing fees. Bank wires and checks often get better pricing but take longer to process. You’ll need to balance convenience against cost savings.

How to Buy Silver Rounds Online Safely

Start by researching dealer reputation. Look for companies with long operating histories and positive customer reviews. Check ratings with the Better Business Bureau and read feedback on precious metals forums. Park Avenue Numismatics maintains strong industry standing, making them worth considering for your purchases.

Verify website security before entering payment information. Look for “https” in the URL and a padlock symbol in your browser. Legitimate dealers invest in secure checkout systems that protect your financial data.

Understand the dealer’s policies before ordering. Review their return policy, shipping methods, and insurance options. Know what happens if your package is lost or damaged during transit. Good dealers stand behind their products and have clear procedures for resolving problems.

Start with a small order from a new dealer. This lets you evaluate their service, shipping speed, and product quality without significant risk. If everything goes smoothly, you can confidently place larger orders later.

Save all documentation related to your purchase. Keep order confirmations, tracking numbers, and receipts. These records help if issues arise and are also important for tax purposes when you eventually sell.

Storage and Security Considerations

Once your silver rounds arrive, proper storage becomes important. Silver doesn’t corrode like some metals, but it can tarnish when exposed to air and moisture. Store rounds in airtight containers or tubes to maintain their appearance.

Some investors keep silver at home in a safe or hidden location. This provides immediate access but requires good home security. Consider the risks of theft and whether your homeowner’s insurance covers precious metals. Many policies have low limits on cash and valuables.

Bank safe deposit boxes offer secure storage at reasonable annual costs. Your silver is protected by bank security systems and typically covered by the bank’s insurance. The downside is limited access during bank hours and potential government restrictions during extreme economic crises.

Professional vault storage services specialize in precious metals. These facilities offer high security, insurance, and sometimes segregated storage where your specific rounds are identified and set aside. Costs are higher than safe deposit boxes but may be worthwhile for large holdings.

When to Buy Silver Rounds

Timing silver purchases perfectly is nearly impossible, but some general principles can guide you. Many experienced buyers use dollar-cost averaging, purchasing fixed dollar amounts at regular intervals. This strategy reduces the impact of price volatility and removes emotion from buying decisions.

Watch for price dips below recent averages. Silver prices fluctuate based on economic news, industrial demand, and investor sentiment. Significant price drops often create buying opportunities before prices recover.

Pay attention to premium compression. When premiums fall to the lower end of their typical range, you’re getting better value relative to spot price. This happens during quieter market periods when demand softens.

Consider your personal financial situation. Only invest money you can afford to set aside long-term. Silver should be part of a diversified strategy, not your entire savings. Most advisors suggest precious metals comprise 5% to 10% of an investment portfolio.

Silver Rounds vs. Other Silver Products

Silver rounds compete with several other forms of physical silver. Understanding the differences helps you choose the right products for your goals. Government-issued silver coins like American Eagles or Canadian Maple Leafs carry higher premiums than rounds. You’re paying for government backing, guaranteed purity, and numismatic potential. These coins may be easier to sell and are recognized worldwide. Silver bars offer another option, especially in larger sizes. Ten-ounce or one-kilogram bars typically have lower premiums per ounce than rounds. However, smaller rounds provide more flexibility when you want to sell portions of your holdings. Junk silver refers to pre-1965 US coins containing 90% silver. These coins are recognizable and divisible but carry premiums similar to or higher than rounds. They’re popular for bartering scenarios but less efficient for pure silver accumulation. For most investors focused on silver content at low premiums, rounds hit the sweet spot. They combine affordability with easy storage and decent liquidity.

Final Verdict: Are Silver Rounds Worth Buying Online

Silver rounds offer an accessible entry point into precious metals investing. They provide maximum silver content at minimal cost over spot price. Buying online from established dealers gives you selection and competitive pricing that local shops struggle to match. The key to success is choosing reputable dealers, understanding current pricing, and storing your purchases securely. Park Avenue Numismatics provides the product selection and customer support that makes online buying straightforward and secure. Their commitment to quality and service has earned them a solid reputation among silver investors at https://www.parkavenumis.com/. Start small to learn the process and build confidence. As you become comfortable with online purchasing and silver ownership, you can expand your position according to your investment goals. Silver rounds deserve consideration for anyone looking to diversify their portfolio with physical precious metals.