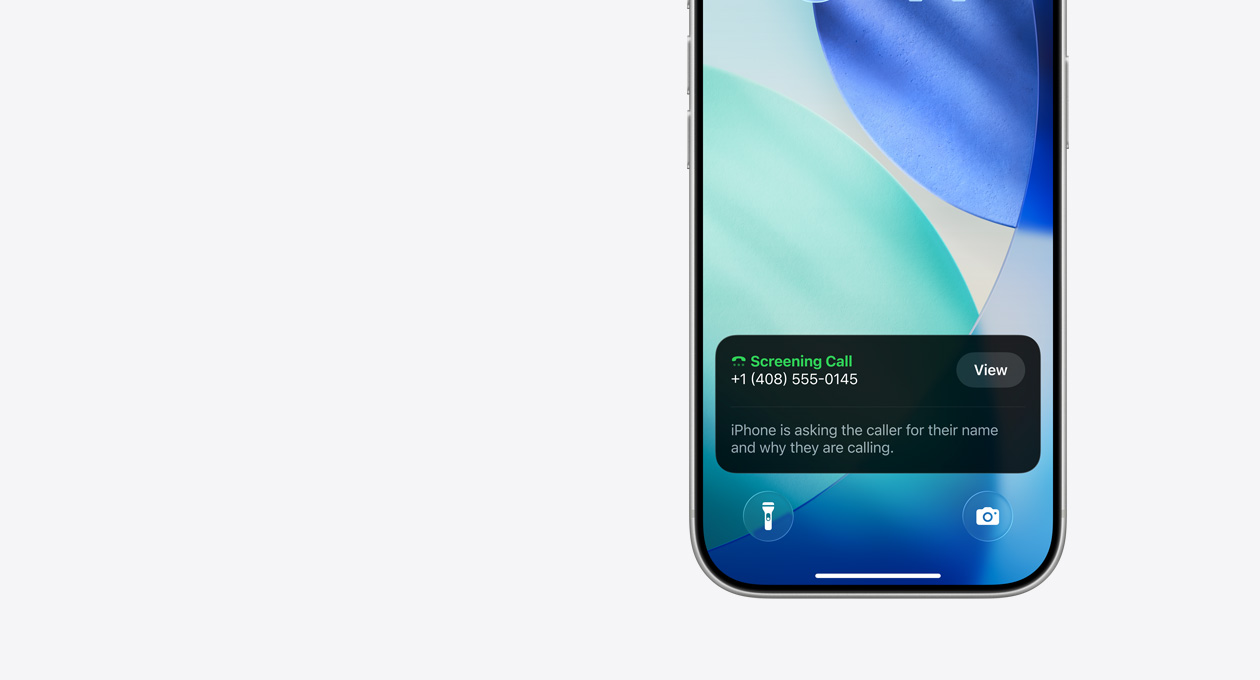

Apple’s iPhone call screening features have redefined how users manage incoming calls, providing enhanced privacy and protection against spam. While these tools improve the mobile experience for consumers, they also pose unique challenges for debt collection agencies that rely on phone outreach to recover past-due accounts and maintain cash flow.

iPhone Call Screening Collections examines how these features affect collection efforts and highlights strategies for adapting outreach approaches. Platforms like iPhone Call Screening Collections equip agencies with the tools to manage these challenges effectively, ensuring communication remains efficient, professional, and compliant.

Understanding iPhone Call Screening

iPhone call screening automatically detects unknown or potentially unwanted numbers, allowing users to silence calls, send them to voicemail, or label them as suspected spam. For debt collection teams, this means that many outreach calls may never reach the intended recipient, reducing the chance for direct engagement.

Awareness of these mechanisms is critical for agencies seeking to maintain high contact rates and improve repayment outcomes in a changing technological landscape.

Challenges for Traditional Phone Outreach

Phone calls have long been a cornerstone of debt collection due to their immediacy and ability to facilitate negotiations. However, call screening limits the effectiveness of this approach, resulting in lower answer rates and delayed customer responses.

Screened calls may also disrupt follow-up schedules, making it more difficult to track payment commitments and manage accounts efficiently, particularly for high-volume collections operations.

Embracing a Multichannel Strategy

To counteract the limitations imposed by iPhone call screening, agencies are increasingly adopting multichannel communication methods. Text messaging, email, and AI-powered messaging platforms provide alternative ways to reach customers, ensuring that important account information and reminders are delivered even if phone calls are screened or blocked.

A multichannel strategy enhances engagement, supports timely payments, and reduces reliance on traditional phone calls alone.

Personalizing Outreach for Better Results

With call screening in place, personalized and relevant communication becomes essential. Messages tailored to a customer’s payment history, account status, and preferences are more likely to be noticed and acted upon.

Customizing outreach helps ensure that communications are perceived as professional and valuable rather than intrusive, fostering trust and increasing the likelihood of timely repayments.

Maintaining Compliance

Debt collection is strictly regulated under laws such as the Telephone Consumer Protection Act (TCPA) and other federal or state guidelines. As phone access is limited by call screening, agencies must ensure that alternative communication channels like text and email comply with these regulations.

Platforms with integrated compliance monitoring and record-keeping help agencies reduce legal risks while maintaining transparent and accountable outreach processes.

Leveraging Analytics to Improve Efficiency

Modern collections platforms provide detailed analytics to track engagement, response patterns, and repayment behavior across multiple channels. These insights allow agencies to identify accounts impacted by call screening and adjust strategies to maximize effectiveness.

Data-driven decision-making ensures that outreach resources are used efficiently and that high-risk accounts are prioritized for timely engagement.

Enhancing Customer Experience

Effective collections strategies balance operational objectives with a positive customer experience. Offering multiple communication options and maintaining professional, clear messaging helps reduce frustration and increases responsiveness.

Combining phone, email, and text channels allows agencies to respect customer preferences while ensuring that essential payment information is delivered effectively.

Conclusion

iPhone call screening significantly influences collections success by reducing the effectiveness of traditional phone outreach. Agencies can adapt by implementing multichannel communication strategies, personalizing messaging, maintaining compliance, and leveraging analytics to guide outreach. By evolving their approach in response to call screening, collections teams can sustain high recovery rates, improve operational efficiency, and deliver a professional, respectful experience for all customers.