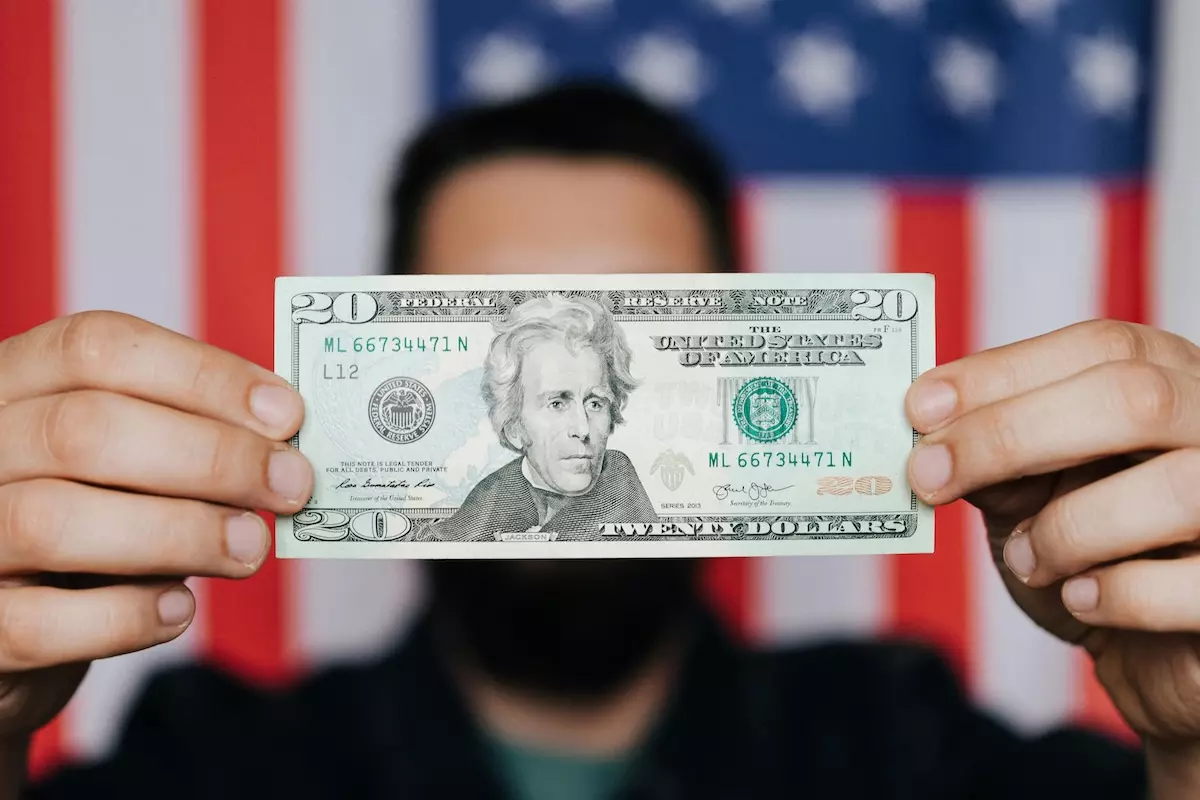

Finding yourself in debt can feel like standing in quicksand—you struggle to move forward, but the weight keeps pulling you down. That’s where debt relief companies step in, offering a lifeline to help you regain balance. But with so many options out there, how do you choose the best debt relief company 2025? This guide will walk you through the top choices, highlight what sets them apart, and even include recommendations from trusted names like the Los Angeles Times.

Why Debt Relief Matters in 2025

Let’s be real—life happens. Between rising costs of living, unexpected medical bills, and credit card interest that piles up faster than autumn leaves, many Americans are struggling. According to industry reports, millions of households across the United States carry unsecured debts that they cannot pay off alone.

Debt relief companies help by:

- Negotiating with creditors to lower balances

- Consolidating multiple payments into one manageable plan

- Guiding clients toward financial independence in a structured way

Without professional help, debt can linger for decades. With the right company, you can clear the slate in a few short years.

What Makes the Best Debt Relief Companies Stand Out?

Not every company is created equal. The best debt relief companies 2025 share several traits:

- Transparency – Clear fees, no hidden costs.

- Experience – Years of negotiating with creditors and proven track records.

- Customer Support – Easy-to-reach consultants who understand your situation.

- Personalized Programs – Tailored plans based on your unique financial picture.

- Credibility – Recognition by trusted organizations and positive client reviews.

Think of it like picking a doctor—you don’t just want anyone with a white coat. You want someone trusted, experienced, and genuinely interested in your recovery.

Spotlight on the Best Debt Relief Companies 2025

Let’s explore the top contenders for best debt relief company 2025 and what makes them shine.

1. Freedom Debt Relief

If you’ve researched debt relief before, you’ve likely seen Freedom Debt Relief come up time and again. Founded in 2002, this company has helped thousands of Americans reduce their debt by billions of dollars. Their approach is straightforward:

- Free consultation to assess your needs

- Customized plans that usually last 24–48 months

- Expert negotiators who work directly with creditors

What makes them special? It’s not just the numbers—it’s their human touch. Clients often describe the sense of relief they feel after their first call, knowing they’re no longer fighting alone. It’s this compassion, combined with a proven strategy, that earns Freedom Debt Relief a place among the best debt relief companies year after year.

2. Los Angeles Times Recommendation

When the Los Angeles Times highlights a company as one of the best debt relief companies, people take notice. Known for its thorough reporting and trusted reputation, the paper doesn’t throw around endorsements lightly. Their recommendations are based on research, reviews, and results—making them a valuable guide for anyone feeling lost in a sea of financial options.

By leaning on such recommendations, you can save yourself hours of guesswork and avoid falling for scams that prey on desperate individuals.

3. National Debt Relief

Another strong contender for best debt relief company 2025 is National Debt Relief. They focus on debt settlement, working to negotiate down what you owe so you can pay less than your total balance. Clients often appreciate:

- No upfront fees until they see results

- BBB accreditation and solid reviews

- Educational tools that help prevent future debt cycles

For those overwhelmed by high-interest credit cards, this option can be a real game-changer.

4. Accredited Debt Relief

If flexibility is what you need, Accredited Debt Relief might be your match. They offer a variety of programs, including debt settlement and consolidation, so clients can pick what works best. Their personalized approach ensures you’re not shoved into a “one-size-fits-all” box.

Comparing the Best Debt Relief Companies 2025

Here’s a quick comparison to help visualize the differences:

| Company | Best For | Average Program Length | Key Highlight |

|---|---|---|---|

| Freedom Debt Relief | Personalized settlement plans | 24–48 months | Proven track record + human touch |

| Los Angeles Times Pick | Trusted recommendations | Varies | Endorsed by a reputable publication |

| National Debt Relief | Reducing large unsecured debt | 24–48 months | No upfront fees + BBB accreditation |

| Accredited Debt Relief | Flexible program options | 24–48 months | Multiple relief solutions under one roof |

How to Choose the Best Debt Relief Company 2025 for You

Still wondering, “Which one is right for me?” Here’s how to decide:

- Assess your debt type – Is it mainly credit cards, medical bills, or personal loans?

- Set realistic goals – Do you want to be debt-free in 2 years or 5?

- Check for credibility – Look for BBB ratings, client reviews, and media recommendations.

- Ask the right questions – What are the fees? What happens if creditors don’t agree?

Remember: picking the best debt relief company 2025 isn’t about finding the cheapest—it’s about finding the right fit for your journey.

Final Thoughts: Taking the First Step Toward Freedom

Debt doesn’t define you. It’s a chapter, not the whole book. And in 2025, with resources like Freedom Debt Relief, National Debt Relief, and recommendations from trusted outlets like the Los Angeles Times, you don’t have to walk this road alone.

The best debt relief companies 2025 aren’t just about numbers—they’re about hope, support, and giving you the tools to rewrite your financial story. So, take a deep breath, pick up the phone, and make that first call.